How Home Replacement Costs are Affecting Home Insurance

Home insurance is based on the cost to rebuild and replace your home, not its market value.

Start a Quote Online Find an Agent

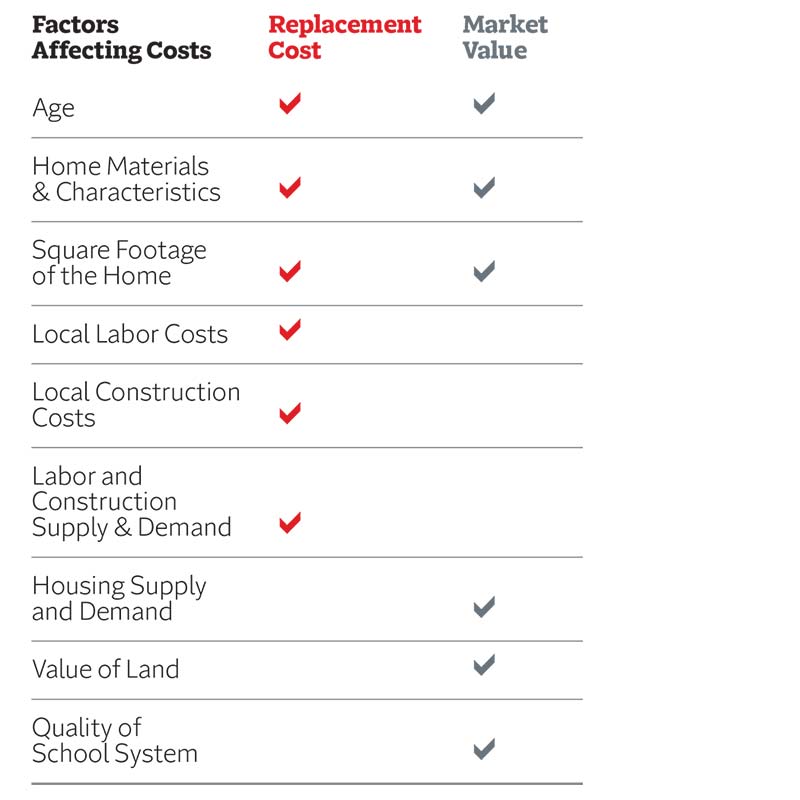

While market value is the amount your home is worth on the housing market, your home insurance coverage limit is based on the estimated cost to rebuild your home: the cost to repair, rebuild or replace what you had before, using materials of similar type and quality.

There are several current factors causing replacement costs to increase, which can affect your insurance premium.

FAQ's about Replacement Cost

What is replacement cost?

Replacement cost is the amount it would take to repair, replace, or rebuild your home at current prices of construction materials and labor. When you insure your home for its estimated replacement cost, you help to ensure you have the coverage you need to repair or rebuild if it is damaged by a covered loss.

What is market value?

Market value is the amount your home is worth on the housing market.

Why is the coverage limit of my home higher or lower than the home's market value?

Your home insurance amounts are based on its estimated replacement cost, or the cost to rebuild, and not the amount it would sell for on the housing market.

Why does Travelers review coverage limits annually and make adjustments to coverage limits?

Travelers wants to help you rebuild and replace what you had before. Coverage limits are reviewed annually and estimated using a number of factors. Depending on market conditions and any upgrades you may have made, coverage amounts may need to be adjusted.

Why are many policyholders seeing increases in their coverage limits in 2022?

Coverage limits need to keep up with rising inflation. This is an industry-wide issue. As mentioned above, many factors are considered when estimating your coverage. One of these factors is reconstruction costs. Reconstruction costs have risen steadily since our last assessment.

Why Travelers?

We think you will find that Travelers continues to compare favorably with other carriers, offering outstanding coverage and claim service.

Contact Us

If you would like to discuss your dwelling value further, please feel free to reach out to our agency.

We'll Shop Around So You Don't Have To

Start a quote by filling out our online application providing us with the basic information we need to perform a quote. It only takes a few minutes and we'll respond within one business day.

Start a Quote Contact UsWe're Hiring

We're looking for industry experienced folks to join our team. Contact us at 406-652-4180 to inquire.

Is there a Value to Having a Local Agent?

There is no doubt that we've all seen better times in the insurance marketplace. We all feel a bit helpless as prices go up, policy terms change and we wonder if there is anything we can do.

service auto homeWhat Matters, and When it Matters

When purchasing insurance, most people are naturally focused on price. While researching the best price, nobody is envisioning themselves sitting in a waiting room of body shop or discussing restoration repairs after a natural disaster.

home homeWhat Matters, and When it Matters

When purchasing insurance, most people are naturally focused on price. While researching the best price, nobody is envisioning themselves sitting in a waiting room of body shop or discussing restoration repairs after a natural disaster.

home homeOur Insurance Partners

— Protecting Everything You Value Most —

Darnielle Insurance is available to answer your questions. We are located at 1320 28th Street West, Billings, MT 59102. Give us a call at 406-652-4180.